It is not like a contract which must be between the two parties to contract completion as it is being taken through, but while considering around. It is required a lot before coming into a long term relationship with your spouse.

It is not an individual living with the same perspective, but there is a role of someone else for a sharing individuality. Many things matter and don’t matter, in a couple’s life, depending on their ideology and equal thinking mentality.

Still, it is necessary to keep understanding about things for managing them with one perception, but it seems a showcase in the eye of people. These days, getting married is not a big deal even fixing up everything after getting married becomes a big deal.

Don’t worry about handling such a situation after getting married because we are here going to give some tips that will help you to go through. If you are not married, but planning to get married soon so these tips are in the form of a set of questions.

And these questions, you must have to put before your fiancé so that further living could be more enjoyable without any surmise. Most of the people in Canada don’t follow this pattern generally before their wedding.

So let’s try to find something out about those questions based on finance which will be helpful for both to continue their relation till death. The reason being, these questions are based on their hidden planning inside them and will give a clear indication.

Top 5 financial questions to go through before getting married:

-

What is the status of credit?

This is a major part of spending life together so it must be cleared between both credit situations. There might be a possibility for a bad credit holding, with anyone so it has to be cleared for further disruption avoiding.

Credit matters a lot in terms of financial circumstances that can’t be avoided by anyone, so asking and knowing the status of your spouse’s credit. It would always be better to go through this and try to sort this out with contentment.

-

How much to pay on treatment for our parents sickness?

Well, if there is agreement on this which will also be a symbol of a true selection of a life partner because concerning over parent’s health. It is out of budget to make after getting married because parents are not items to which financial decision making required.

But still, there is no issue between the two so your wedding life might get the position of immortality after no financial planning required. For the treatment of sickness of parents, who also did not discuss the finance about your health-related issues in your childhood?

-

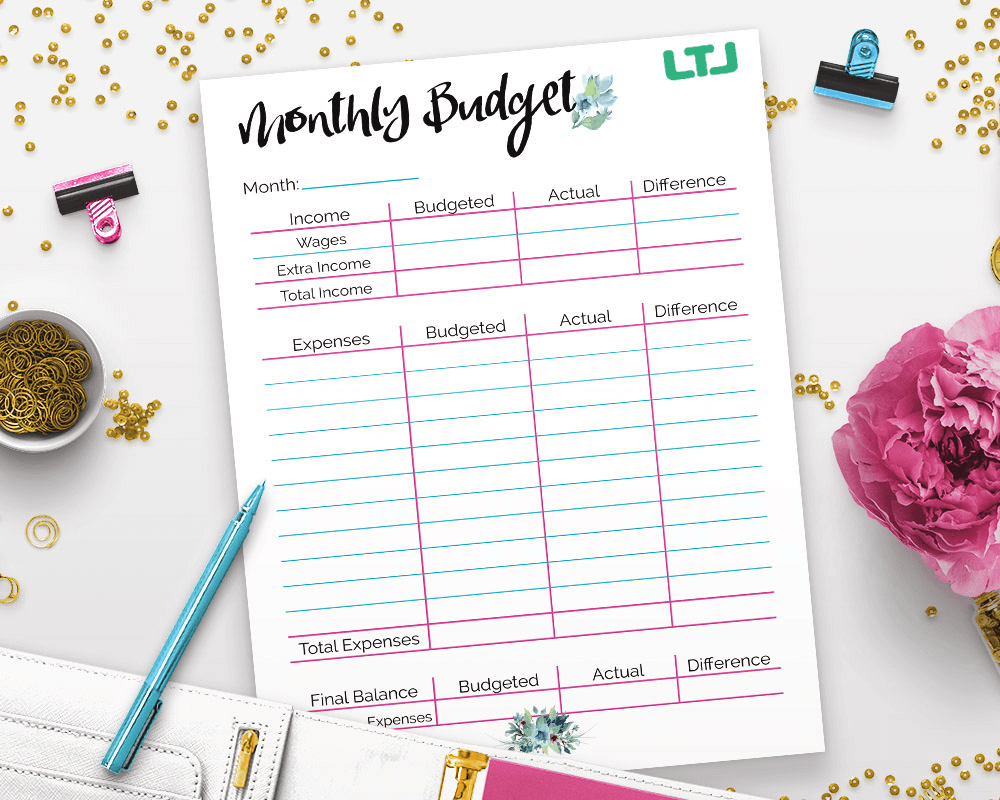

Who will take care of bills?

This must be the major concern to discuss with your fiancé because pending bills can turn into debt and later on it can bring trouble along. So there must not be any kind of confusion related to financial background.

Whoever takes care of bills, another one’s payment must be for an investment or saving for the future because after getting married, there will be expenses. One’s payment will take care of other expenses while life leading head.

-

How emergency situations to be handled?

There is no specific name mentioned for handling emergencies so having discussions over emergency issues to be handled seems bizarre between the two. An assurance is compulsory for helping while intricate situations are there to face.

Before getting married, it is necessary to know because of most of the time, while facing emergency situations nothing works. And there is no guarantee for the partner to support after these situations have come so it is also a must for the confirmation.

-

Should there be joint accounts or separate accounts?

The situations keep on changing which does not mean your life partner will remain as he or she was earlier so it is better to ask. And one of the considerable points, it does not matter what someone says, before what he or she does after a time.

But still, it is important to keep a separate account because the partner may take his or her turn after your condition gets worse.

The bottom line

It is very important to think more than two times before taking a step ahead which sometimes troubles in the case of finance. It is finance that is a need and it wants which is hidden behind the need so both have to be balanced equally.