The debt can be in any form of utilities bills and other bills to repay, but there is less possibility seems to pay. Along with this, these small left payments are to be paid before a stipulated time before which these are known as a debt.

And many borrowers find themselves under debts after becoming unable to pay them off and there might be different circumstances for such an occurrence. So in that case, debt managing helps to get rid of the pending debts by paying.

Under a debt, many times, borrowers have to face a depression and an anxiety because due date is approaching and there is no money left to repay. Therefore, borrowers switch to a debt consolidation to eliminate their pending debts, sometimes.

Many times, borrowers’ face multiple issues of debts as mentioned already are more of them such as credit card debt, personal loans and unsecured debts. These are enough to get you down completely with a heavy stress for not paying them off.

So whatever your concern is related to your debt, we are here to guide you in a way which will play a crucial role for your stress to get out. And accordingly, you will be able to live your life happily after following the same way.

What is debt management plan?

How much it is worth it to consolidate a debt for you? Borrowers can get their all the pending credit cards debts into one larger monthly payment debt. It can be possible as per their ability and budget. Many borrowers look confused after falling into the debt consolidation which works at a time to reduce the entire stress.

This is called the management by taking all your debts into one and it gives the long term stress elimination after putting a step forward.

How does the debt managing plan work?

First of all, your financial ability and conditions will be put on check that your credit counselor will be responsible for putting. Without which, no further activity will be there to be in the process that’s why it may not be easy at first by the credit counselor.

-

If you are eligible enough for the same plan or not, this will be there to check.

-

If you are going to get the approval of the DMP with possibilities.

-

What is your capacity to pay every month for your debt?

Accordingly, it will be decided ahead as per your limit of making payment on time before meeting with any loss in an individual living.

What are alternatives to debt management plans?

Without knowing additional profits of the other side, it is not the right wisdom to follow the targeted one. Because the other side’s profits can also be very useful for advantage-taking so let’s come across the other side of the benefits.

- With good credit, you can go for a debt consolidation where you can take your entire debts into one and you will have a possession over the debts. And one of the essential parts that will be with lowers interest rates.

- One of the options of bankruptcy can be considerable with more than 40% of your yearly income. And there is no other option you assume around to repay it within the time of 5 years; this can really be helpful for a new starting.

What are signs of financial trouble to become aware?

These signs can’t be anticipated until you face them at present, but there are some precautions that can be taken to avoid the affects of the troubles. Some unexpected expenses are also their parts that may know your door any time.

Without knowing you are cashless or you have a huge amount of cash available with you because such expenses are inevitable. It is better to be aware of them before facing; here are few tips to look at down for a good future.

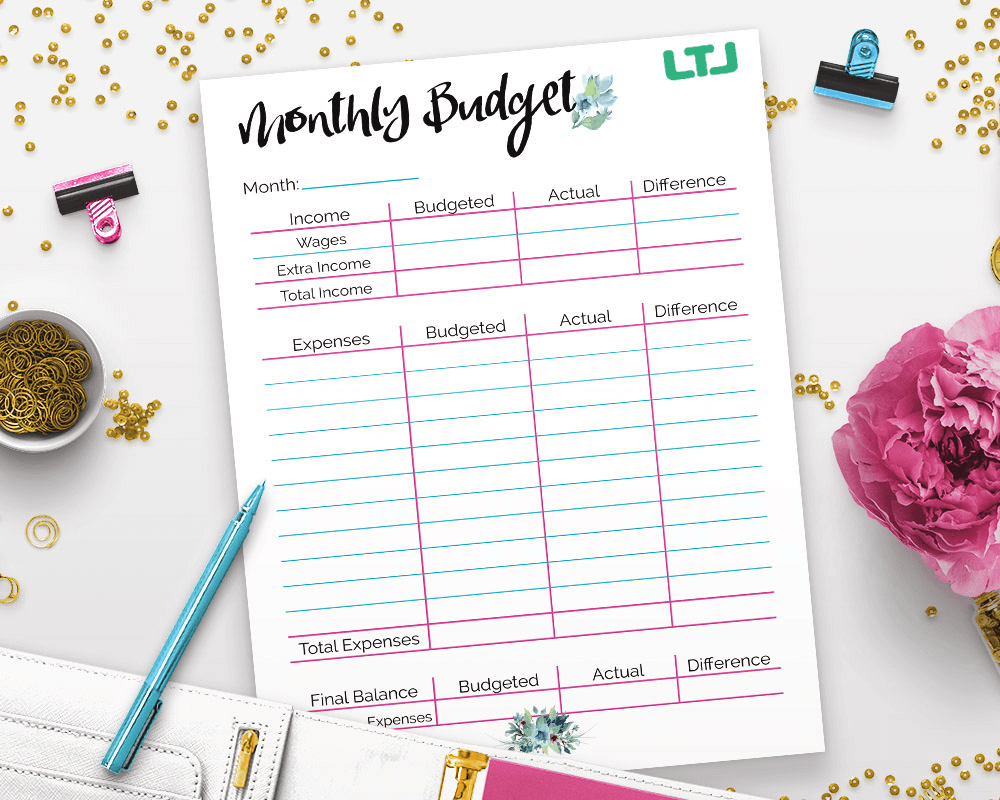

- Start making a budget

- Cut off the unnecessary expenses

- Find any source of income

- Start a saving

- Keep the credit score maintained

How do loans work with debt management?

Loans come with an assistance to provide to the borrowers with fulfilling their any sort of needs, they are unable to fulfill. Such loans come in two forms as long term loans and short term loans, both are totally different from each other.

It depends on the borrowers and their need to go for them when it comes to the debt management which comes with an option of debt consolidation.

Read Also: How Can An Installment Loan Affect Positively On Your Low FICO Score?

What is the importance of a planning making?

Making a plan is the first step to a new step for something unavoidable event because without any plan the consequences may harm later on. Therefore, in regards of financial events, this is very indispensable to look at before any stepping further.

Why We Care

Management of anything plays an important role, in case of anything. Because this teaches a lesson of how to avoid snags that seem to be in the way ahead. Similarly debt management is also required for tackling them through an easiest way by following.

- Can Debt Management Plan be a good Idea? - August 6, 2020