Generally speaking, rules brings guidance to our life. When we value them positively, it births a sense of predictability and continuity to our lives. Whatever you do if it is controlled by laws or rules, saves you from going crazy. Rules are what help guide actions towards desired outcomes.

Once we cross the age of 30s, our financial planning becomes a little more serious. But possible money rules at hand helps in managing funds and achieving financial security.

Why 30 is the best age for financial decision-making?

Here are some common, tried, and tested 10 rules that can be useful for planning your money life:

1:- Spend Strategically – WHAT IT IS?

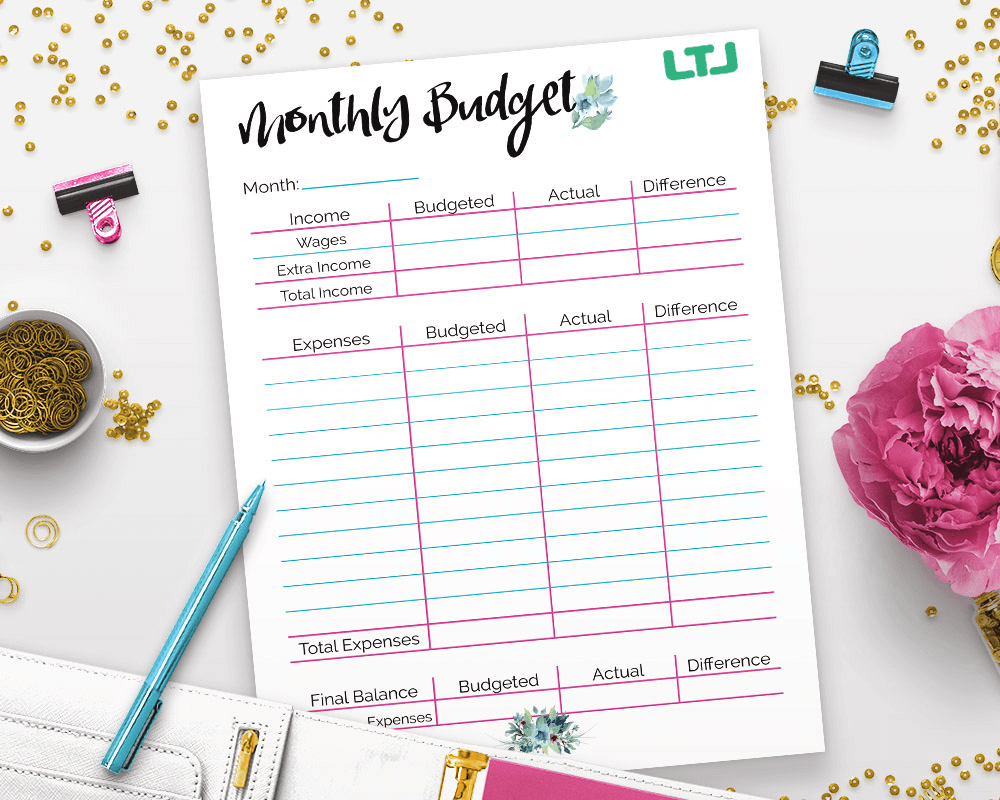

The word “budget” is what has been bothering us from the very beginning. The meaning of “budget” remains the same, only the time and situation change. In childhood, pocket money had to be budgeted to buy toffees, and when we are 30 or near, then the budget has to be made for other important things. But by the age of 30, mastering basic financial matters is required. Whether you are employed or unemployed till this age, it is important to know where the earnings are coming from and exactly where they are going, and where they should go.

2:- Understand Your Insurance Policy– HOW TO?

An insurance policy is a legal contract between you (individual or join), a business, or insured entity (car or home), and an insurance company (the insurer). Home insurance for home, auto insurance for the vehicle while life insurance is the norm for health problems for you and your loved ones. These are some types of insurance that most people need.

Learning and understanding the policy document is much more important than buying the policy. You should know what your contract says and how they are put to use in daily life. Understanding policies helps you to confirm how much you are spending on them. Are our lifestyles, risks coverage, and premium amount all purposeful? This is a good time to know if the available plans and terms are suitable for you.

3:- Have a Will – WHY?

You may be a person who thinks that the very wealthy or those with complicated assets only need a will. However, there are not only legal reasons for making a will, but there are also pure emotional reasons that determine your wishes.

If you are in your 30s, having a will is an important part of your overall financial plans. It is a legal record that can resolve every possible issue that may flame up after your death. Failure in preparing a will leaves the decision regarding your assets in the hands of judges or state officials which can also lead to family discord. Dying without a Will – The transfer of the property is determined based on the Wills, Estates and Succession Act.

That is why, before you are gone, you must spend extra time, money, and emotional energy to settle your successor/s (will) matters. It’s not as complicated as you think, and you can also get ready-made drafts for free by doing a Google search.

4:- Pay Down Debt First – WHAT SHOULD YOU?

There will be more than 90% of the houses on earth where a woman keeps the accounts of the entire budget. It is also believed that a woman learns to keep accounts from a young age. By the time the woman is turning-30, she becomes even more adept at budget planning. How much money comes in and how much goes out or how much debt and how much savings, everything is accounted for accurately.

But it is a bit tricky to decide between debt and savings. What should be better? Pay off debt first or save first. The decision between the two options depends on personal situation and prioritize. To solve this, ask yourself the following questions:

- What’s My Job Situation?

- How Much Do I Have in Emergency Savings?

- Do I Need Other Savings?

- What Type of Debt Do I Have?

- Am I Expecting a Potential Windfall?

- How can I pay off debt faster?

- How much money should I save every month?

If you go into this concern into adulthood, these FAQs may be helpful for you to start thinking about – Pay-Off Debt First or Save First.

5:- Establish an Emergency Fund – WHY?

If you gave a priority to “pay off debt first” then now you have to focus on saving. Because you should have emergency exits to way out safely in any unexpected challenges of life. If you are a dependent (housewife, student, or anything else), then make a plan and save a certain amount regularly. If you are self-employed or doing a job and planning to make a big purchase then also save to meet that goal or its expenditures. Saving is a good habit, which can rescue you from life’s surprises.

Somehow, if it is not possible for you, then you can also use online emergency loans for your instant money needs and emergencies.

6:- Invest in Valuables – WHY?

This stage of life is a good time to start investing in more quality things. Only spend on what helps you perform at your best. Be it furniture, travel experiences, or a wardrobe that aligns well with your goals.

7:- Know Hourly Rate – WHY?

Time is Money! Doing it yourself can be better than paying someone else to do a task. Give yourself a dollar instead of hiring task rabbits in a project.

8:- Diversify Beyond Your RRSP – WHY?

If you’re the woman who’s investing in RRSP– like savings, that’s well done. But you should also think beyond retirement investing and saving. At this age, you have at least 3 decades to go as long as you can plan well for retirement. In your 30s, you have the perfect opportunity to small cash contributions to other investing accounts. There are a million different micro-investing apps like WealthSimple Invest, Wealthica, and PocketSmith are geared specifically to help women think about investing.

9:- Evaluate Your Financial Progress – HOW?

Financial health is just as important as your physical health. As much as it is important to make a money plan, it is equally important to evaluate those set goals. What financial goals did you want to achieve? Did you get them! To make evaluation easier, break down goals into smaller steps and measure how you’re progressing toward goals. Tracking any expenses or investments in your 30s periodically makes sure you’re evaluating.

10:- Build a Money Philosophy – HOW?

Maybe you didn’t turn into your 30s but are on a way to having a clearer sense of all parts of financial life. Or maybe none of us, even know about it. What works best with our financial philosophy? By the 30s, we start to know and it should be, whether we are looking for a partner, city, or job.

Learning Objective:

The year gone has proved that there are certain things that we cannot control. The pandemic affected many people’s jobs, their health, and many aspects of their lives. This global crisis has made us realize that no planning is ever good enough.

This article puts together 10 money rules, the specialty is that they are organized but not obstructed. If you want to make your dreams and desires come true, there is a need to be disciplined about saving and spending as well as investing wisely.

- Don’t Ignore These 10 Money Rules Before You’re 30! - February 25, 2022