Financial emergencies can be a burden on your pocket at in anytime which affects the overall budget that you had established. Not having enough funds to meet your personal needs is one of the best examples of hard financial times. Many people don’t have any idea about what to do during such times which is also another problem with cash shortages. Are you also experiencing the same right now? In case yes, then you are at the right place luckily.

The solution is online installment loans in Canada from direct lenders for you to make big purchases like buying a car, house, and other sorts of big purchases. The interesting thing is- you can get an instant approval for long-term loans and advances with us because our reputable lenders are different from conventional creditors. Also, you don’t have to pay back the debt in short term, unlike short term loans before paycheck that borrowers have to refund by the next paycheck.

What is an Installment Loan in Canada?

Installment loans are a set of amounts that protects you from getting wet from emergency rains. You have to pay back these types of rainy day funds as well with interest rates over a period of time. In fact, this is preferable a lot by many Canadians to their financial comfort. There are various forms of these loans which include: Car loans and mortgages. But this is not the case only because you can take these payday loans in Canada for dealing with other things as well.

The loan amount that you borrow will matter how much you have to pay off your loan every month along with interest rates. No doubt, traditional lending institutions take you through the lengthy process if you are approved-but our direct lenders take care of your problems to treat you.

You can get advance cash from $100 up to $5000 as per your requirement so that you can cover your long-term or short-term needs. In most places, their repayment terms are different according to the law of the state and lenders’ policies.

The Complete Guide to Getting the Best Installment Loan-

Achieving the best installment loans might be problematic in certain places, but not all the places. There are still some places where you can get these funds very easily. But many people have the same question about how to get them.

This is actually considered a lot, when you see some lacking factors behind getting loan approval -you still have hope. Many online lenders don’t care what they are actually because you are important to them at that time.

That’s why they put you on the application process turn with no heavy objections. All you need to do is go wisely filling a short page online application with some ordinary information of yours. Your confidential details make them confident enough to assist further.

Obtaining personal installment loans is very simple now:

- Application is the beginning: Yes, you have to fill out a simple page online application which is an essential part of the loan process. Fill the empty columns very carefully to avoid rejection of any sort.

- Some personal information required: Here must be some columns belonging to your personal background such as ( your name, address proof, your profession, and the loan amount you are looking for)

- Maintain the patience: Having done all that, you have to have some patience so that you can get the loan approval confirmation. A notification bell will let you know about that so kindly accept that, whenever it pops up.

- Submit now: You have to click on submit now button for submitting your loan application. Funds are transferred to your bank account anytime on the same day to handle your prevailing emergencies.

How to Apply for an Online Canadian Bad Credit Installment Loan

There are several financial institutions that are willing to work with you for guaranteed approval for installment loans with bad credit in Canada. Most of the institutions including banks and credit unions may demand some collateral so that they can recover their funds after you are failed to repay.

The truth is these types of funds are unsecured loans for which you have to pay nothing to anyone if you are with online lenders. We are aware of the fact that there are many people living with bad credit which doesn’t mean they will be deprived of loan facilities.

How do you apply for an online loan with bad credit: Your bad credit or no credit will work in getting loans with the same loan application process as for good credit holders. But the bet is you have to repay the loan with no delay this time. Because you already had your FICO score bad which might be worse than earlier?

How Online Canadian Installment Loans Lender Can Save You Money and Time?

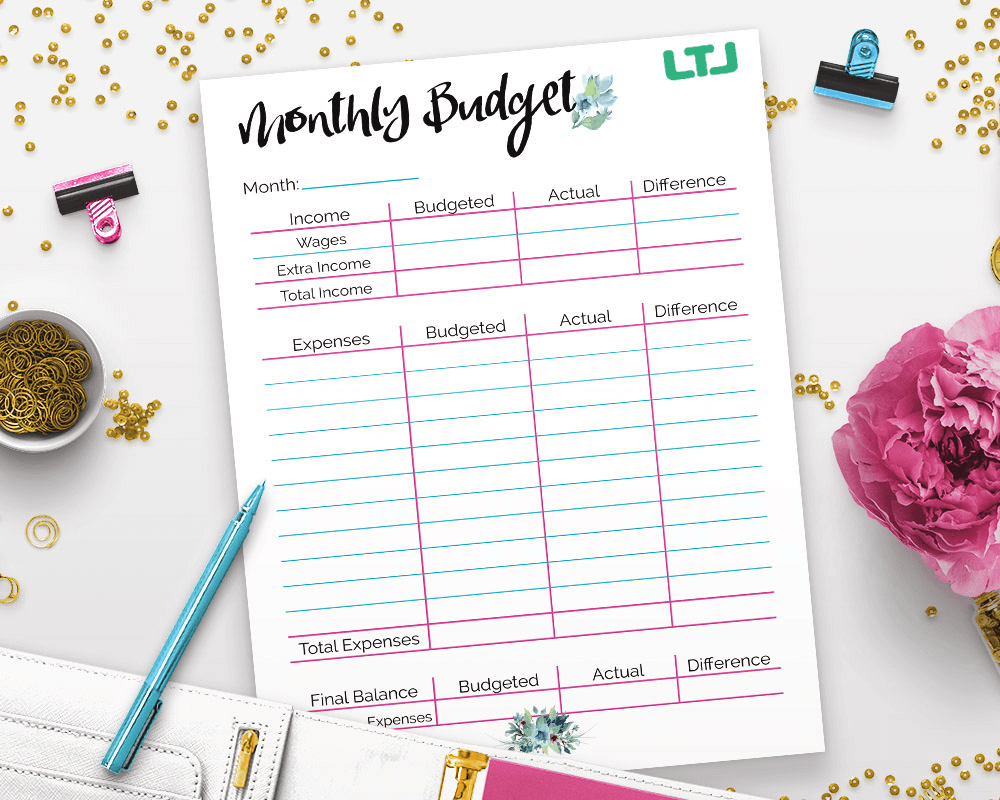

There are times when people are failed to repay their installment loans on time in Canada which turns out to be a burden on their pockets. But there are also times when you can find yourself able to pay off your loan prior so that money can be there for saving.

The only way- you can save your money is by repaying the best payday loans in Canada as soon as possible. Since these types of loans have fixed payments for you to pay that’s why there is no restriction on how much you pay off your loan.

Our direct payday lenders are the lenders who don’t take you through the long process which saves you enough time. On the other hand, visiting conventional lenders takes your entire day for completing the overall loan process.

How to Avoid Getting Scammed by Installment Loan Companies in Canada?

There are many scams about installment loans in Canada. But there are a few loan scam warning signs which will let you know that you are being scammed. In such cases, you have to be alert to them because we don’t want your faith to go away with authentic loaning services.

It is very important from whom you are applying for bad credit installment loans because many traditional lenders keep on scamming by targeting people like you.

Time to be alert to fraud companies with easy tips:

- They need no credit check guaranteed approval only: This is where you can guess that you are not at the right place because legitimate lenders find it part of the process. And there is no guarantee for approval when you have to crack the loan application process which can be either positive or negative.

- Front fee: This is another way that you are supposed to be scammed when they are demanding a fee upfront. In such a situation, you have to be very careful and you shouldn’t agree with what they say to you.

- Their banner is faded: Many such money lending institutions are there who keep on offering loans to the people, keeping their helplessness in their mind. Their company logo is faded even though they don’t care about it so you have to stop yourself from taking risks.

- Getting phone offer: Keep a distance, when you are getting a loan offer by phone because this can’t be the legitimate way to trust. A legitimate way, when everything is in writing so you shouldn’t accept it at any cost which has a maximum chance of a scam.

Installment Loans vs Other Types of Loans – Which One Is Better?

There are various types of loans available to people like you and each of them have its own terms and conditions for applying and repaying. Installment loans are one of the loans which are better than other financial products like payday loans which give enough time for repayment.

Both the loans have their own purposes to use still people prefer them according to their needs and choice. Although both are known for providing fast cash, people experience the difference in both loans.

Look, at the difference between installment loans and payday loans:

Installment loans: Combining other sorts of loans such as car loans and mortgages, they are known as installment loans. There is a huge comparison between installment loans and other loans like payday loans. In the case of installment loans, you can get the required funds upfront and you have to continue repaying them over a period of time. You get a car loan for 3 years and 30 years for a Mortgage.

Payday loans: Payday loans are usually small-dollar loan amounts that are available for a short time period for covering emergencies. The only problem, people usually face with these loans, they have to pay much after they are failed to repay on time. People have to pay off their loans as soon as possible as compared to installment loans.

Can You Get a Loan With No Credit and No Savings Account? And Why Would I Need One?

Yes, that’s true. You can get installment loans under any circumstances, you are in. It doesn’t matter; you have no credit or no saving account which is essential for almost all the lending institutions. No credit shows that you haven’t done anything financially and not having a bank account how you would collect the funds.

Yes, you have to pay high interest rates with no credit if you have that because, in this digital time, you can easily get access to loans. Things have changed enough from old times when no credit used to be a problem for getting financial products access.

How do you get a loan with no savings account?

Online loans like installment loans are loans, direct lenders send you from account to account for some safety purposes after you have got the approval. In today’s time, people are not good as they look, and that’s why our direct lenders don’t want to take any risk by giving loan approval.

Debunking the Myths that Surround Installment Loans in Canada

First of all, you can get installment loans in Canada as fastest as no one can come ahead to provide them except direct lenders. There is no complication in getting loan approval from reputable direct lenders. There are a number of reasons that people resort to these types of loans whenever they find themselves in the pinch of cash.

But unfortunately- there are some misconceptions about bad credit installment loans which should be dispelled from people’s minds as soon as possible. There are a few myths that you should be aware of that are actually not true.

Several misconceptions to avoid:

Myth: Once refused by banks, you can’t apply again.

Reality: This is false. You might not get loan approval for personal loans due to your lower credit score. You can approach some direct lenders where you will have your loan approval in a couple of minutes.

Myth: Needed higher income source.

Reality: No, it is not necessary for reputable online direct lenders because you can prove to yourself that you can repay your loan on time. Yes, how you do that. Therefore, you can show any sort of available income that you have right now including government benefits you must be getting.

Myth: bad credit not accepted.

Reality: Your bad credit score is one of the negative factors which is considered a lot by lending institutions for loan approval. But you can find some trustable direct lenders who don’t notice this and you can get the loan approval despite having a bad FICO score.

Myth: Hidden fee associated:

Reality: There is one more myth about installment loans these have hidden fees. Probably there is, with traditional lending institutions. But while applying with direct lenders, you don’t have to pay any hidden charges.

Conclusion: The Truth Behind Canadian

Every Canadian has their own perceptions to think about loans, but installment loans no credit check have made them think a bit differently. While setting up a comparison between installment loans and other loans, you will experience for yourself which one is best.

Anyway, Canadians who worry about the negative factors in terms of getting loans whereas can experience a wonderful time with www.LongTermLoans.ca!

- Installment Loans for Bad Credit $2,500 | Granted Without Verifying Your Credit - June 15, 2022

- Installment Loans Canada – Fast Cash Loans That Banks Can’t Offer - May 20, 2022

- Get Approved Bad Credit in Canada? Long Term Loans! - March 11, 2022