The installment loans for bad credit are the loans that help you to get the money you want, in small amounts. You can take them from a direct lender or online lender so that you do not have to provide any collateral. With these loans, you will receive your money immediately and at the same time, you will make payments for a period of time until it is fully paid off. As this type of loan does not check your credit history before giving out funds, it’s perfect if you’ve denied by any bank or credit card provider.

How Installment Loan is Different from a Payday Loan?

An installment loan is a type of loan that is paid back in monthly installments, typically for a large purchase that you cannot pay for all at once. Installment loans also known as deferred payment loans because the lender gives you time to pay off your loan by extending the term of repayment.

The benefits of an installment loan include:

- Flexibility: You can make payments as often or as infrequently as you want without penalty (as long as they’re made on time), which is great if you can’t afford to repay your entire balance each month but would like to keep up with payments.

- Security: Your payments automatically deducted from your checking account so that there’s no risk of losing them due to mail delays or other issues related to paper checks.

What if you have a bad credit score?

If you have bad credit, you may be facing a lot of roadblocks when trying to get approved by traditional lenders. But with installment loans for bad credit, there’s no need to put up with the hassle.

Installment loans for bad credit are available online! You don’t even have to leave your home or office to apply for an installment loan. And the best part is that they offer similar repayment terms and interest rates as bank personal loans – at a fraction of their cost!

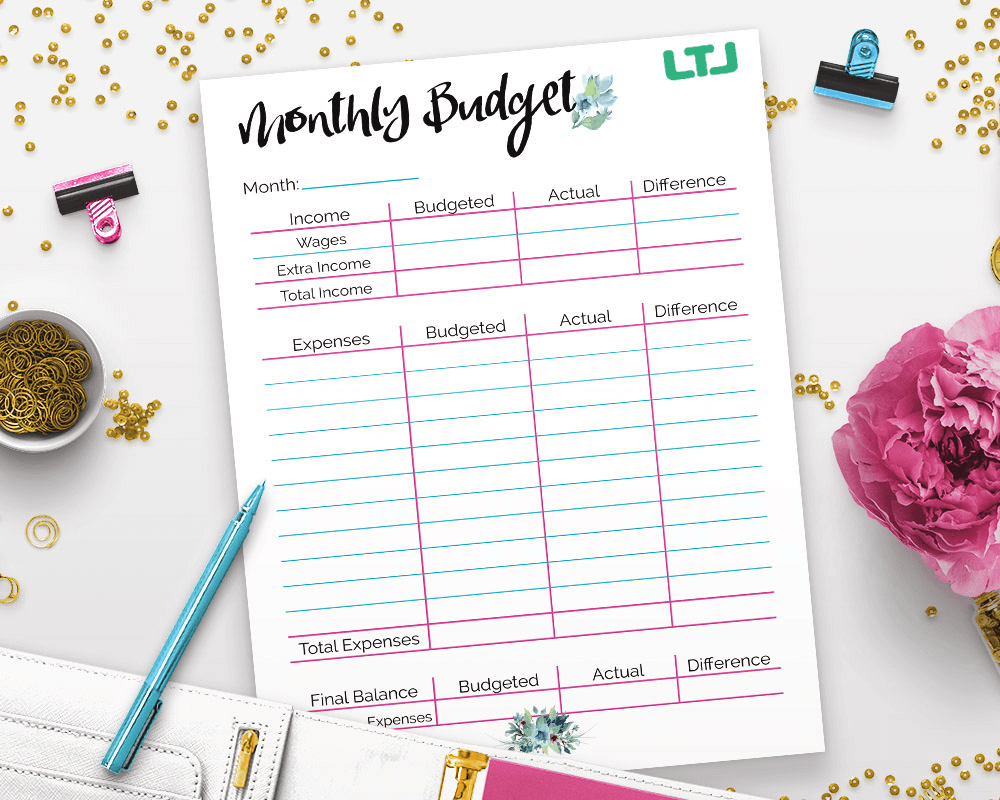

Calculate your loan rate

You can calculate the loan amount, monthly payments and total interest paid by following these steps:

- Enter your personal information in the boxes on this page. You will be asked to provide your annual income (before taxes), current debt and other details about yourself.

- Click On Calculate Loan! to see how much money you qualify for based on lender’s guidelines, as well as what kind of monthly payment you’ll need to make.

Loan with Bad Credit by Direct Lender or Online Lenders

If you’re looking for an installment loan for bad credit, but can’t find one through a bank or credit union, there’s another option: private lenders or online lenders.

Private lenders or online lenders are individuals who are willing to lend money and charge interest on their loans. They may be willing to work with borrowers with poor credit history, because they don’t need to check FICO scores when deciding whether or not to offer a loan. In fact, most of these lenders will approve applicants based on income alone. If the borrower can make regular payments according to what the lender determines is affordable for them. And still cover their basic expenses each month (rent or mortgage payment plus utilities), then he or she is likely eligible for an installment loan from this type of lender.

$2,500 Installment Loans for Bad Credit

You can get a $2,500 installment loans for bad credit from a private lender. The interest rate is much higher than other types of loans and will depend on your credit history and other factors. However, these loans are available to people with bad credit who need money quickly. To qualify for this type of loan:

- You must be at least 18 years old

- You must have a job or income source that you can use to repay the loan

Online installment loans no credit check Canada

If you have bad credit and require a personal loan, it can be hard to get the money that you require. If traditional lenders are not an option, there are other options available, such as online no credit check installment loans. These loans designed specifically for those who do not qualify for traditional financing due to their low credit scores.

Here’s how these types of loans work:

- You fill out an application online or over the phone with your details like income and employment status

- The lender will review your information and decide whether or not they want to lend you money

- If approved, the lender will deposit money into your bank account

Conclusion

In conclusion, the installment loans for bad credit are a great way to get money when you require it. You can apply online and be approved within minutes. The best part is that these loans are available from private lenders who specialize in helping people with poor credit history get approved for financing.

Common Questions About Installment Loans Canada:

Why I Use Installment Loans?

Installment loans offer you the money power to manage sudden expenses.

| • Home Repairs and Renovations | • Auto Maintenance and Repair |

| • Life Milestones | • Vacation |

| • Personal Injury | • Debt Consolidation |

| • Timely Investments |

What credit score do I need for an installment loan?

To be eligible for an installment loan from a major lender, you must have a credit score of at least 580.

What is the easiest loan to get approved for bad credit?

Payday lenders, car title loans, pawnshop loans, and online installment loans are likely to be the easiest bad credit loans to get approved for.

How do I figure out my monthly installment loan schedule in Canada?

You can figure out your monthly installment loan schedule with our lender’s loan calculator!

Can I Get an Installment Loan in My Province?

We are Toronto based, but we can help you with $2500 installment loans for bad credit if you’re located in any of the following provinces. Fill out an application today!

| • Ontario | • Alberta |

| • British Columbia | • New Brunswick |

| • Newfoundland | • Nova Scotia |

| • Nunavut | • Prince Edward Island |

| • Yukon |

- Installment Loans for Bad Credit $2,500 | Granted Without Verifying Your Credit - June 15, 2022

- Installment Loans Canada – Fast Cash Loans That Banks Can’t Offer - May 20, 2022

- Get Approved Bad Credit in Canada? Long Term Loans! - March 11, 2022