Are you a bad credit holder and you are planning to improve your credit score? So don’t worry, long-term loans are here to help you revive your credit score. You just have to pay more attention and keep reading the article till you reach the conclusion.

Without a good credit score, you may not be good at getting approval, and almost all the time, you face failure for your loan approval. And with a good one, you can apply for all kinds of financial aid with low-interest rates.

Online Installment Loan Instant Approval Canada is also one of the long-term loans which are really helpful in increasing the credit ranking as you get enough time to collect the money. And after collection, you have to pay off the loan without breaking the payment term process.

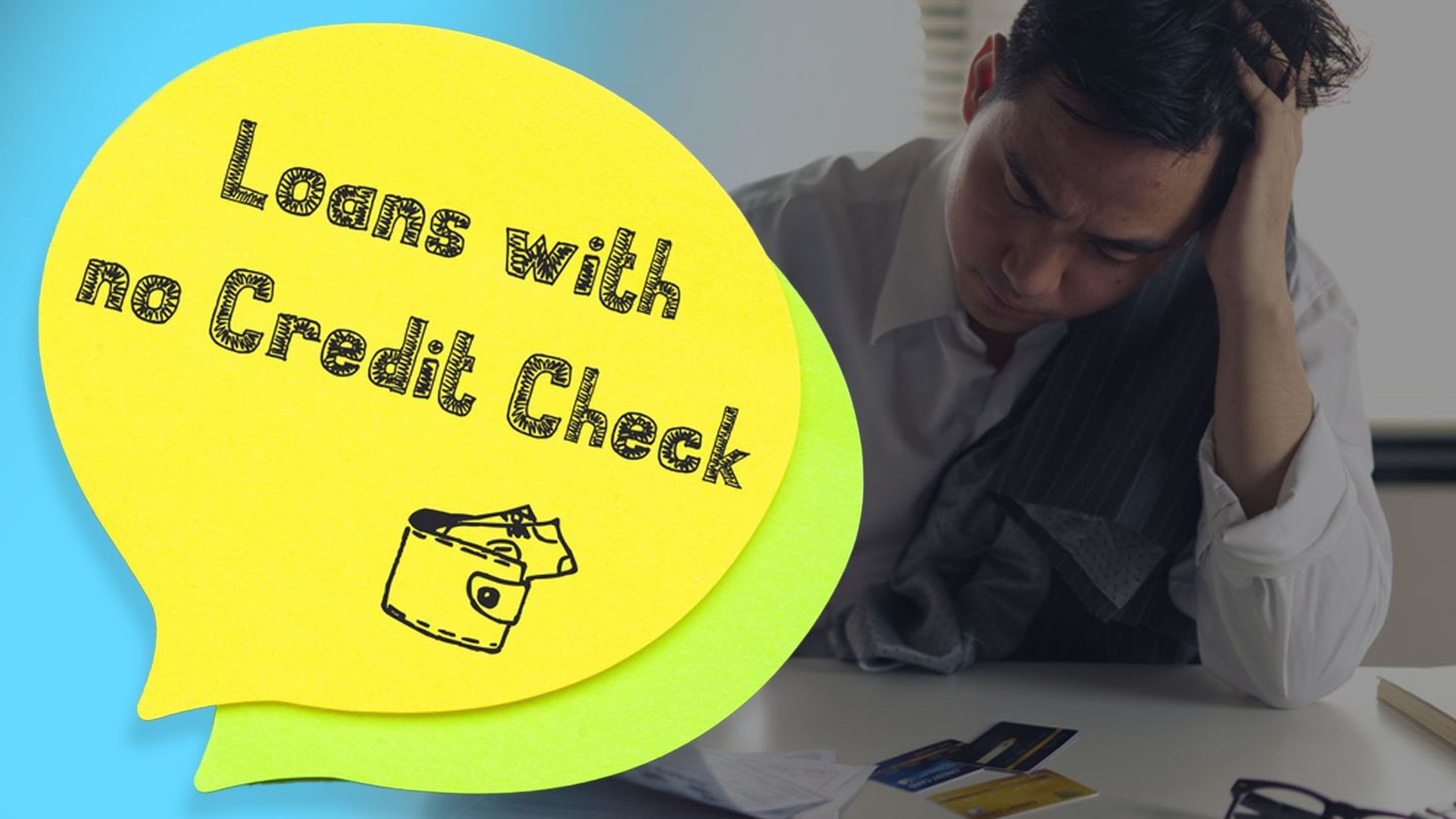

Thus, making regular payments without any defaults will affect your credit history and this affection towards your credit will bring good results. And that’s where you see it. How does credit score get better through installment loans no credit checks?

In the case of applying for a loan, a mistake can be dangerous for further activity as there is a credit history that counts the activity to be paid. And a missed payment can affect credit score improvement.

Therefore, you should consider making timely payments to avoid damaging your credit score. Almost all the borrowers applying for loans face bad credit problems to meet their needs.

What are installment loans?

These loans are long-term loans and are generally considered to be safer and more economical alternatives to payday and title loans which help borrowers to pay multiple times with a fixed amount. Such loans are really useful to meet the requirement and moreover, you get enough time as per the policies to repay your loans. Because many traditional banks and moneylenders intend to take advantage of this on the pretext of providing long-term financial assistance.

Read Here: What Are Installment Loans Online And Its Top 5 Benefits?

How do these loans work?

After applying for this type of loan, you can avail these loans by repairing your favorite car, paying fees, renovating your home. Apart from this, you can make big purchases with this financial help. With the help of this type of loan, you can meet the emergency expenses without any hassle which you never expected.

How can I apply for such loans?

Completing multiple banking formalities for loan approval makes it difficult to apply through private financing providers and traditional banks. But you can go a step further to apply for no credit check installment loan online guaranteed approval.

It is a very simple process to apply for a credit check loan online without any paperwork while applying. And it works faster as compared to other financial sectors to get a loan approval without any kind of hurdle.

When can I get these loans after applying?

Many financial institutions wait for this day to come as you approach them for loans and later, you have to wait for a long time. Especially to benefit them by waiting their turn and bribing them as commission for your loan approval.

After applying through Long Term Loans, you can get instant approval and get approval by getting a notification message. You can get money in your checking account within half an hour after the application process is complete.

How can I be a good credit score by applying for these loans?

Such loans have a longer tenure as compared to other loans where you have to think from all angles before applying them. With these loans, you have enough time to make payments as you have enough time to arrange cash.

After a cash arrangement, you can pay them off without any defaults, thus improving your credit score. After continuing this, your credit score goes from bad to good so that you can take further financial assistance from any authorized financial institution.

Can I apply for Installment loans already having bad credit?

Having bad credit is not a problem in applying because that is where your bad credit turns into good. But you need to be able to repay the loans and you can apply them based on your current income.

Because your current income will greatly help in getting loan approval and based on this, you can pay off the loan by monthly installment repayment.

Conclusion

An installment loan is one of those loans where there is no stipulated time to make the payment but the payer has enough time to make the payment. And if there is no income then these loans give time to arrange income for the money collected for payment. It is one of such profitable no credit check loans online and gives relief to the borrowers from going under any stress.

- How To Make A Monthly Budget And Save Money? - June 28, 2021

- What is my credit score if I have no credit? - August 21, 2020

- Christmas is coming? Here Is Everything You Need To Know About Installment Loans? - August 6, 2020